As of May 2018, an adjustment to the China Customs Advanced Manifest required that extra information be supplied on shipping documentation (such as the Bill of Lading and INTTRA submissions). Indonesia then followed suit with a similar requirement.

Known scenarios where these apply and what is required:

Shipping to China

- Consignee USCC Code must be provided, Contact Name and Phone Number wanted

- If Consignee is To Order, the same information must be supplied for the Notify Party

- Exporter Enterprise Code

Shipping via China (transhipment)

- Exporter Enterprise Code

Shipping to Indonesia

- Consignee Tax ID must be provided, Contact Name and Phone Number wanted

- If Consignee is To Order, the same information must be supplied for the Notify Party

- Exporter Enterprise Code

These known applications are based on actual data and may not be comprehensive, it is recommended that you familiarise yourself with the CCAM requirements to ensure that requirements are met.

Terms:

- USCC – Uniform Social Credit Code, an 18 digit code assigned to companies operating in China.

- CCAM – China Customs Advanced Manifest

- Enterprise Code – Defined as the Shipper’s tax identification number; for example: European VAT number etc however there is no clear consensus as to what to send in NZ (IRD Number, Company Number, NZBN, others?). Company Number is becoming more prevalent and Maersk particularly enforces this.

- Tax ID – The tax number of companies in Indonesia

Prodoc

Based on discussion with multiple exporters, INTTRA and shipping companies the Prodoc implementation can cover all of the above scenarios. It is not automatic and must be applied (at standard hourly charges).

Our implementation (unless requested, this is not already applied)

The implementation on Prodoc is as follows, a set of background functions are applied, as well as changes to the forms (BOL and INTTRA) to display the USCC/Tax ID and Enterprise codes if required and matching an instance against the Customer.

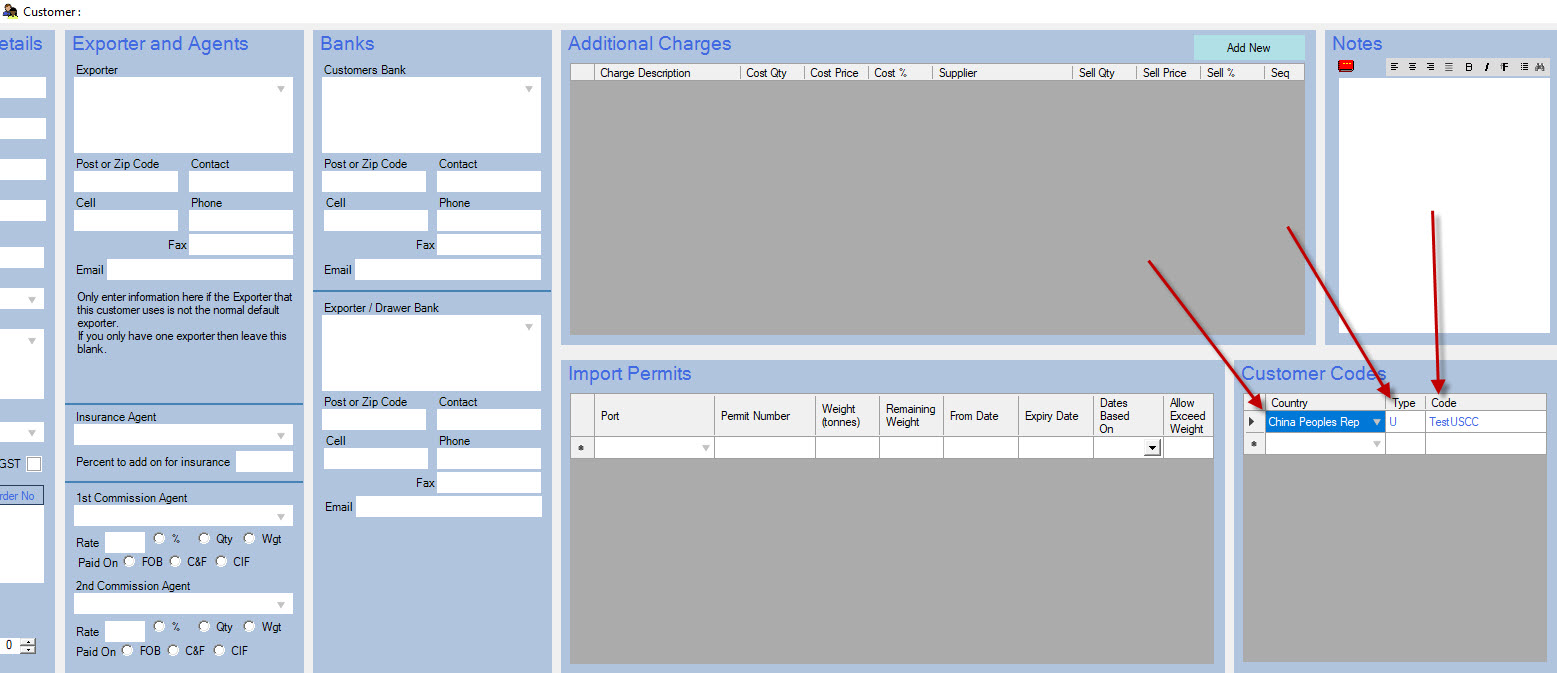

On the Customer, you use the Customer Codes table on the far right of the Customers themselves:

Select the applicable country (China or Indonesia) and set the Type as U to display a USCC code reference, or T to display a Tax ID reference.

When this Customer is then selected on a shipment, and the Discharge or Transhipment Port is in China or Indonesia, then the matching code will be applied against the Consignee on BOL and INTTRA forms. If the Consignee is To Order, then the same will be applied against the Notify.

If you have multiple consignees/notifies against a Customer, and subsequently multiple codes, this implementation on its own probably won’t work for you (you’d have to keep going in and changing these). Get in touch with us and we can tailor something to your needs, one customer has the codes supplied from their ERP system, so a workaround was applied that overwrites the code within the Customer with the supplied value. Alternatively a field can be supplied on the shipment that can write against the forms where the codes are entered.

On INTTRA generated SLIs, this will show as ‘Government Reference Number’. This is an INTTRA designation and cannot be overcome by Prodoc.

If you require the USCC/Tax ID Changes

Please get in touch with Prodoc Support, this is a change from an external source and is not automatically applied, the implementation will be applied at the regular time charges.